WHATEVER BECAME OF THE ENVY OF THE WORLD?

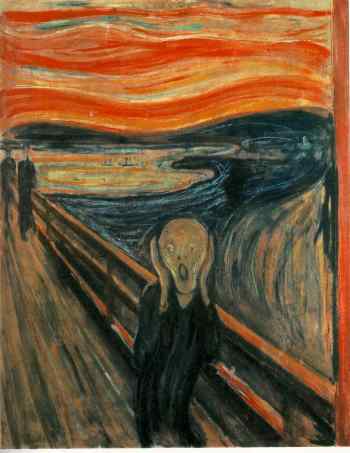

'The Scream' by Edvard Munch

THE PENSIONS AND PERSONAL SAVINGS CRISIS.

Different Perspectives.

By now most people who read or watch the news will be aware that all is not well with the state of pensions provisions. The more perspicacious will also have noticed that there has been a massive boom in consumer credit, allied to a reduction in personal savings, whilst at the same time many people have piled into property as a form of security, which has propelled private property prices to levels beyond the means of many average earners. What is the import of all of this for people and society? What forces and factors lie behind the current problems and disquiet?

What follows are some slightly different accounts than those normally found in official reports and government explanations.........

PART ONE.

SAPPING BRITAIN'S MORALE - A ONE ACT FANTASY

THE SCENE - A wood-panelled room in the Kremlin, KGB operatives sit round a large mahogany table. Major-General Krookov, head of Soviet financial espionage, presides at its head.

THE TIME - The mid 1970's.

Krookov: "Comrades, you have been working on our master plan to undermine the morale of the British people for some time - now we await your report...."

Project leader: "Comrade General, we have prepared a plot of devilish cunning and complexity - a plan that will impoverish many amongst the populace and destroy confidence in their reactionary government and capitalist institutions".

Krookov: "Good, lets hear it, things are not going so well in the Cold War. We need a victory."

Project Leader: "Comrade General, first some background. You may know that the workers of Britain have very good arrangements to pay for their retirement after a working lifetime being exploited by the capitalist dogs of industry.

Our plan is to undermine this system of 'Retirement Pensions and Savings', which the British believe is 'The envy of the world'. By the time our strategy has been fulfilled, the British workers won't know what has hit them and they will seek to blame the government, and the vile cradle of capitalism that they call 'The City'. If the workers have any spirit left, they should take to the streets in their millions and be ripe for revolution".

Krookov: "Even better, now let me hear the plan, please, the First Secretary is going to love this"...

Project Leader:

Before we become more specific, Comrade General, let us explain some scenarios and theoretical ideas. Comrade Brainyovski, please explain to the General, but keep it short."

The bespectacled, short-sighted Brainyovski rises, coughs nervously and begins:

"Comrade General, some new and potent ideas are taking hold in the capitalist countries. The most powerful are a belief in the universal power and positive potential of something called 'Market Forces' and the conviction that letting people who are driven by greed have their way will be good for all in society. Associated with this is the ridiculous idea that letting the most avaricious loose to make as much money as possible will benefit all through such strange mechanisms as the 'Trickle Down Effect'.

The power of these ideas will drive their financial markets to frenzied madness, cause governments to abandon any ideas of taking care of citizens' interests and cause said citizens, poor exploited people, to believe that they 'deserve anything they want, when they want it', with no need to save for their old age.

Associated with all of these things, an industry is springing up that will pretend to take the place of government in serving the interests of responsible citizens who wish to save for their own futures.

But here's the rub, this industry will almost certainly be corrupt and greedy, will tell lies and mislead the citizenry, who have not been educated to know anything of the cunning and avaricious ways of financiers. So, even the more responsible members of society will be betrayed....."

Krookov, (looking sceptical) - "So, what is your plan - be quick, please"....

Project leader:

"No plan is needed .We will not even need to do very much, Comrade General. We can just stand back and watch governments, and the capitalist institutions of industry and the financial markets, aided and abetted by Parliament and such strange manifestations as the 'Accounting Bodies' so undermine the interests of their citizens that they will lose all faith in the whole capitalist system that has impoverished them in their old age, wasted their taxes on stupid policies and projects and undermined their savings.

Governments will renounce responsibility for the interests of their citizens, but do so gradually and by stealth. From time to time, driven by public outcry, they will feel they have to intervene and as a result make matters even worse.

But in the main, they will hand over power to greedy capitalist institutions which will fleece the people, whilst seeking to persuade them that all will be for the best. Many big companies will fall under the power of these institutions and lose any sense of responsibility for their employees.

Meanwhile, the people, persuaded by much propaganda - that they can trust governments to look after them - that they can become wealthy by giving their money to dishonest usurers - and that they can borrow to fulfil their rights to 'Have it all, Now' - will indulge in orgies of consumption and forget that one day, the Reckoning will come.

By this time, it will be too late....."

Krookov: (turning white with cold rage):

"Never have I heard such fantasy and nonsense - not even the agents of corrupt capitalism could act so stupidly - and how can we expect all these government and other bodies to act in concert to betray the people over such a long period, when we all know they couldn't organise an orgy in a bordello!! I cannot take this 'plan' to the Politburo.

You have wasted my time......" (Reaches for switch under the table......)

PART TWO

THE PENSIONS CRISIS - ROOT CAUSES; THE FULL STORY?

Conversations between two old fellows with long memories.

What follows is an account of the current pension and savings crisis and how we came to be in the state we are in. This story is a record of a series of conversations between Don Young, who was the Director of Human Resources for several large British-based international companies from the early 1970's to the late 1990's; and Ian Hamilton, who was a pension fund manager from the early 1980's, then Director of Compensation and Benefits for a large international company, whilst also being a trustee and then chairman of the Trustee Boards of that company's pension funds.

The 'story' is probably not one that will be found in the reports of respectable enquiries sponsored by governments or the financial services industry - in the minds of our two conversation partners they have too much to answer for to be totally objective.

We hope that what follows may throw some different light on what has happened to our pensions over the last quarter century or so, and thus some clues as to the range of measures that, with a little will, might be taken to alleviate the current problems.

Young....

It seems like we're in a hell of a mess with pensions and savings, be it from the State or occupational schemes. Just think, only five or six years ago, we were congratulating ourselves on having a far superior system to the benighted continental Europeans. What on earth has happened since then - have we all decided to live longer suddenly - is that it?

Hamilton....

It's not just that we are living longer, although that is a major factor. We've known about that and its impact on pensions for many a year, so it shouldn't have been a surprise and could have been factored into actuarial calculations for a number of years past.

Young...

So what the hell's going on? Thank God you and I are pensioners already, seems like we are the uniquely lucky generation - things were not so good for our parents, and Lord only knows what will happen to our children....

Hamilton....

Well, it's quite a long story. Can we get a cup of coffee before we start?

(A few minutes later...) What was I saying - must have had a senior moment..... Oh yes, The State Pension. Now, to begin.......

Let's step back in time to the good old days of the 1970's and consider the State pension. In those days there was a sort of implied 'contract' between the citizenry and the State, as represented by the government.

If a citizen worked hard all his (more often than her) life and paid income tax and National Insurance; then come retirement, the state would pay a pension that related to their income up to a certain level. People got used to that idea, and although the amount was modest compared with the state pension in most continental European countries, at least it was increased in line with average earnings.

So, when the link between the state pension and earnings was broken, people didn't like it and there was quite a lot of protest, but I don't think that the long term implications of severing that implied contract really sank in with most people. And maybe they still haven't. I think that a lot of people somehow still feel that it is the duty of the state to take care of them in their old age.

Young....

OK, so people want the state to sort of nanny them. What about Occupational Pension Schemes and personal savings - the Great White British Hope?

Hamilton...

Not so fast... let's stay a moment with State pensions. As you know, these are paid for out of current taxation. Now, in the years since the implied 'contract' to link pensions to pay and pensions was broken, we have seen a vast boom in North Sea oil revenues, plus a massive sell-off of State property via privatisation. I reckon that some people might have a right to ask what became of that national bonanza? All gone on lowering taxes? I would guess not, without knowing for sure. I think that there has been a lot of 'leakage' of those revenues into wasteful projects, such as foreign wars and the Dome; high costs of bureaucracy, and policy blunders, such as those that created disastrous inflation and ' boom and bust' - under both Tory and Labour governments.

It seems like the Norwegians are being rather more prudent with their North Sea oil revenues and saving some for the future.

Young...

Norway has always seemed to me like a most splendidly sensible country.

Hamilton...

Yes, agreed - I was there with you and Charlotte on your boat - maybe you've forgotten.

Anyway, back to the plot - Occupational Pensions. Let's take another journey back in time.

First a little known fact. The duties of occupational pension fund trustees are to the beneficiaries of the fund - pension fund members, as you have just said. But trustees have a duty to safeguard the interests of all the beneficiaries of the scheme, which includes the company that is providing contributions towards the fund, so the company is legally a beneficiary, not just the members.

In the old days, there was generally speaking a benign and mutual relationship between companies and pension fund members.

Given the encouragement of tax concessions from Government and the relatively low level of state pension provision, most companies accepted the responsibility of providing pension benefits for their permanent employees. Most top managers were motivated to provide competitive benefits - and in turn, pension fund trustees, helped by the company CEO or finance director who were often trustees too, sought to minimise the costs to the company through prudent stewardship of the scheme's assets.

OK so far? Right: onwards....

Come the days of Maggie T, it was decided to let freedom and enterprise loose. Companies were no longer allowed to provide pensions for employees through compulsion and employees were free to seek better and more flexible arrangements through fully portable private pension plans, or maybe no provision at all beyond that which the state provided.

Wonderful! Let private enterprise rule! But, there was a woeful lack of advice and guidance to individuals as to what they could do - and the consequences of different courses of action. So, the populace were a little like lambs surrounded by the ravenous wolves of the financial services industry.

This move had several quite seismic impacts on occupational pension schemes:

- The incentive for companies to provide pension benefits for all employees was significantly reduced. Many companies, like Redland, still endeavoured to persuade employees to save prudently through membership of the pension scheme - but many did not. And many younger employees rejoiced at the extra cash available for immediate consumption - and took no steps to provide for themselves - they vaguely assumed that the State would take care of them when the time came, many years in the future.

- The financial services industry was gifted a bonanza - sell personal pension schemes like there was no to-morrow! Bonuses in showers for salesmen, who travelled the length and breadth of the country, misleading and sometimes swindling people in their hundreds of thousands. Seldom has there been such a rip-off!

And, despite the fact that the incoming New Labour government (still fresh and idealistic), tried to shame the industry to provide some measure of compensation, many people were badly burned. Pension and insurance companies took a long time to admit liability and aeons longer to make redress for their misdemeanours.

Result? Some people were much poorer - and, most seriously, the seeds of mistrust in the financial services industry to provide reliable and trustworthy savings vehicles were thoroughly scattered on fertile ground, which has been copiously watered and manured time and time again right up to to-day. But more of that later.

Young...

And is that it?

Hamilton...

By no means! I've hardly started.

You have heard of companies taking pension contributions 'holidays' when the stock market boomed....

You may know that companies were taxed on pension fund surpluses over a certain amount, despite the fact that most funds were heavily invested in the stock market, which has always been cyclically volatile - and were thus penalised if they wanted to store up surpluses for a rainy day...

You may want to speculate on what companies did with the more than £23 billion that they saved through 'holidays'. Maybe the word 'speculate' might give you a clue.

We will certainly touch on the behaviour of the Stock Market and Investors, and the effects of their irrational exuberance followed by mass manic depression.

Of course, as you may guess, governments have weighed in fully with their own contributions to the pensions and savings mess. One of the worst examples was government encouragement for a huge growth in home ownership, followed by raising interest to record levels as a result of gross economic mismanagement.

You may have heard of FRS17? If not, I'll explain what a disaster I think this has been.

You may wish to think about the investment strategies that pension funds embarked on, helped by their advisers - who are supposed to help generally amateur and often innocent fund trustees choose prudent investment strategies.

You have certainly heard me fulminate about Mr Brown and his sudden tax burden on pension funds, just before the stock market was about to collapse.

You will be titillated by the further amazing antics of the financial services industry, with (for example) such 'stars' as Equitable Life squandering the Additional Voluntary Contributions that many prudent people had put away to supplement their pensions.

In fact, the whole of this period is punctuated at regular intervals by scandals misbehaviour by the Financial Services industry. So regular have the scandals been and so predictable the losers - Joe Public - that you might almost believe there was a malign intelligence behind it all.......

And then there have been periodic consumer credit crises, as people take on too much debt to sustain unsustainable lifestyles. The financial services industry has to take a lot of the blame, as they bombard the populace with promises of instant credit to 'have it all' - instantly. Any ideas of deferred gratification have long been thrown out of the window.

Oh - and the actuarial profession now tells us that as we're all living longer, there would not have been enough to go round anyway (How can such a predictable process apparently have come as such a surprise?) This is obviously a serious 'discovery', but I strongly believe that its effects on pensions would surely have been mitigated if it had not been for all the other things.

But, for now, that's enough. It's high time to go for a drink - I've got a roaring thirst, what with all this talking.

Let's continue with the tale of mystery and intrigue when we meet next time

PART THREE

Further conversation between two old fellows with long memories.

Young

What Ho! Did you have a good festive season?

Hamilton

Not bad - and you?

Young.

Pretty good, I've put on a lot of weight and broken two ribs in a mysterious fall - about par for the course in the season of jovial excess.

Hamilton.

I won't ask how you came to break the ribs.

So what are we going to talk about to-day - refresh my memory, I'm a little vague about where we ended up last time.

Young.

We were talking about companies reducing their pension contributions because stock markets were booming, and pension funds were amassing large surpluses which the government taxed if they got above a certain level, despite the fact that the stock markets were entering a period of massive exuberance which any idiot with half an eye for history could see was going to end in a crash.

Markets have been behaving like this since the South Sea Bubble so it should not have been difficult to see all the bullshit about 'New Paradigms' for what it was - bullshit, if I'm not getting too repetitive.

Funds should have been allowed, nay, even forced to build huge surpluses to tide them through the coming stock market crash.

Hamilton.

Whoa down! Before you tear off on one of your rants, let's go back and look coolly at surpluses and other factors that affected the behaviours of occupational pension funds.

Let's look first at the taxation of surpluses. The facts are thus. Occupational pension funds are required to calculate the value of their assets and the cost of their liabilities on a basis laid down by government. These calculations must be made using conservative assumptions about investment returns and salary escalation and then if the value of their assets exceeded their liabilities by more than 5%, they were required to put forward a plan which would reduce the surplus to within the 5% excess within a 5-year period. This could be achieved by either increasing benefits (but only up to levels laid down by government) or reducing contributions or some combination of the two.

Failure to do this resulted in the withdrawal of tax relief on the interest that was deemed to have been generated by the surplus. Got that? Nothing is simple in this racket.

We in the pensions game thought that this was not unreasonable at the time. What we didn't cater for was all the other things that subsequently happened.

Young

Such as?

Hamilton.

Well, the stock market boom went on for a long time, enough for all concerned to get lulled into the assumption that the investment conditions of the mid-1980's to mid-1990's were somehow normal.

Those companies that took pension contribution holidays sort of got used to the idea that pensions didn't cost much. Many large funds were comfortably in surplus assuming that investment conditions stayed broadly the same as they were over the mid1980's to mid1990's. What we didn't predict was how steep or prolonged the decline in equity values would be.

So, when the stock market crash started, companies that had been spending their pensions 'Holiday Money' on such useful things as dividends to investors, Mergers and Acquisitions and all those things that I can see you are bursting to tell me, got the shock of their lives when they began to realise the sizes of their fund deficits - in effect, they were faced with having to invest more than the 'Holiday' amounts, having already spent the 'Holiday Money'.

If you can hold your water for a little longer, let me finish.

Round about this period, the august bodies that set our accounting standards came up with, what they thought was, a good rule - it was called FRS 17. Now, I haven't got a lot against accountants, but this rule, whilst appearing to be rational by itself, when added to all the other things that were going on at the time, simply added to the mayhem.

Young

Nice to see you defending accountants. What did they do?

Hamilton

OK... The bean counters decreed that companies would compare the value of their assets and liabilities at a spot Valuation Date, usually one day every three years. If there was a liability it had to be shown up in the company's books for that year.

Of course, in the world of accountants this is strictly true, but it added to the drama by highlighting deficits in one year, despite the fact that in the long-term world of pensions, companies could afford to make up the deficits over many years. Before FRS 17, the drama didn't exist, because deficits or surpluses were not reported in this way.

So, FRS 17 simply added another element of mainly perceptual pressure to a situation that was already becoming somewhat drastic. I know that you will get on to the subject, but another element of pressure was the increasing aggressiveness of the financial markets, which saw pension fund contributions as lower returns to them, not sensible investments in employee welfare and commitment, which they cared not a toss about. There - I've stolen your thunder!

Young

No worry. I've got plenty of thunder to come. Proceed with your tale - I can see that you are working up to something....

Hamilton.

Right! Just as things were warming up nicely, what with stock markets about to drop dramatically, companies coming to realise the size of the disasters caused by their funding holidays and of course, the squeeze coming on their businesses from the recession - just as uncertainty and gloom were beginning to spread, along comes Mr Gordon Brown looking for a sneaky way of raising more taxes whilst appearing to keep to the New Labour promise of no tax rises.

What could be better than pensions as a source of income - long term, so people would not see an immediate effect on their incomes: apparently in surplus, the recession had not yet bitten the markets - all the conditions needed for a 'stealth' tax.

So, he reduced the tax exemptions on pension funds' investment dividends.

The net effect of this has been about £5 billion per year immediately paid in to the government's coffers - about £40 billion taken out of the occupational pension system since 1997, even more than the £23/25 billion taken out by holidays - say £65 billion taken out in total since the late 1980's.

If we put it all together: The combined effects of pension fund 'holidays', the fact that companies had got accustomed to the idea that pensions could come cheap, FRS 17 that suddenly highlighted pension liabilities in a new way, Gordon Brown's still un-acknowledged tax disaster and a right royal recession to boot, then the magnitude of the temptation for companies to do something drastic can be seen in its full glory. The last straw was pressure put on many companies to reduce their pension fund costs by short-term investors who cared not a toss about pension fund members - despite the fact that they could be argued to be the real 'shareholders' on whose behalf the whole investment system is supposed to be working.

I'm bound to say that, like a lot of others in the occupational pension field, the Brown tax rankles with me the most - and he won't even acknowledge that he has played a significant part in the problems that we currently face.

It makes me mad: ministers, MP's, senior civil servants - the whole lot of them - they're fireproof, bombproof, insulated from the up's and downs of the financial markets with inflation-proofed pensions that they can draw from age 55. None of the bad things that happen to others need concern them - I'll bet Brown would have thought twice about stealth taxes if his own and fellow MP's pensions had been adversely affected - his own pension must be worth well over a million by now.....

Before I finish, you will be pleased to know, if you don't already, that we are all living longer and therefore more savings will be needed to pay for our pensions in old age. This highly predictable trend has burst into the light of day relatively recently and is being used by many who are looking for some way of deflecting the spotlight from their part in a very complex multi-faceted tragedy. Yes we are living longer. Ye, it will cost a lot more to fund our increasingly long old age. Yes we will probably have to save more or work longer or some mix of both. And, yes, the Government Actuaries must have known about the likely effects of increasing longevity for years but seem not to have persuaded their masters to start preparing for it until the full tsunami crashed on our heads - and if they didn't they should be shot for incompetence.

Young.

Ha! And you say that I'm prone to having the odd rant!

Now.... Is it my turn? Good...

I'd like to paint a broader picture, to fill in the background against which our great pension drama is being played.

Remember, we started out speaking of pensions and savings, because both are supposed to be a way of enabling people to put funds aside in preparation for the time when their earning power will go down, the years when new vistas can open up and the demands of full-time work can be reduced. Like it ought to be for you and me right now but isn't because we are both still bitten by the work bug. But I would assert that people in general should have a few options towards the end of their lives as to how they spend their time.

Hamilton

So, what's the picture that you see?

Young.

A pretty horrifying one - a bit like Edvard Munch's 'The Scream' against the background of a tornado.

Look at it this way:

We have concentrated on the occupational and state pensions picture so far - and have seen that governments, investment markets, the financial services industry and companies have all played a part in undermining the pension rights and entitlements of the ordinary citizen - no need to take pity on high earners like you and me and other top managers whose entitlements have not been affected.

Let us place the pensions piece of the jigsaw into a wider canvas - that of the whole gamut of financial pressures that come on people through their lives

Let's start and take a look at the people most affected by all of this - the average working person. We are talking of people who are not by and large financially sophisticated. Here's an extract from a speech made by Carol Sargeant of the Financial Services Agency in 2003 that gives you the picture:

People in the UK are also relatively inexperienced and unsophisticated when it comes to matters financial. This is hardly surprising after two generations of mainly welfare state and employer provision. Many consumers have also still not fully adjusted to the implications of a low inflation environment and probably don't understand the liability side risks they are running any better than their savings and investment risks.

It is hard to overestimate the extent of financial illiteracy amongst some consumers. Let me give you some illustrations from recent research. Many consumers have serious numeracy problems. Research by DFES has shown that one in four adults cannot calculate the change they should receive out of £2 after buying three items costing less than that. A significant number thought 10% of £300 was worth no more than £25. Some rather older research by the OFT showed that only 64% of consumers might be expected to draw the right conclusion when comparing 2 APRs and 23% of the sample could not explain what a percentage was.

A more recent survey by NOP for Invesco found that half of investors surveyed (and over two-thirds of the public at large) do not understand the difference between equities and bonds.

The FSA's own research and that of the independent Consumer Panel is also revealing. One quarter of pension and endowment policy holders did not realise that their money was invested in the stock market. 57% of consumers never or hardly ever read the personal finance page in their newspapers. Consumers find financial information difficult to understand and frequently fail to read or retain the information provided. 56% of consumers agree or strongly agree with the statement "I find it hard to understand financial leaflets". Even products designed to be simple confuse consumers - only 33% of consumers thought cash ISAs were straightforward for example.

We are talking of a population that, for no fault of their own, do not know much about investment, savings or the ways of the financial services industry. We are talking of many people who have been brought up in a world that is full of messages about what they deserve and what they should want - "Because you're worth it", to quote the ad.

Therefore many people are inclined to try to have their cake now and let the future take care of itself. The financial services industry has risen vigorously to the task of persuading people that they can have it all now - and with guaranteed low APR's (whatever those are).

Politicians have put in their penny-worth by spreading the word that people have never had it so good and that everyman/woman deserves to own a house, whether they can afford it or not.

The leisure, fashion and consumer goods industries have weighed in with saturation advertising telling us and our children of our rights to consume as we wish - with ever lower prices and ever better value.

It makes me mad that apologists for the financial services industry write as though the population ought to know how to deal with their finances and that 'caveat emptor' should rule.

On the other side is the financial services industry - the 'supply' side of rampant consumerism. It is important to retain some perspective when speaking of this complex and huge industry made up of many often inter-linked institutions. But I think it would be reasonably fair to say that no other industry has been guilty of such deception, mismanagement and general sleaze as this one. We will talk more specifically another time, as dinner time approaches and the wine is waiting, but I think I could place my hand on my heart and say that the behaviours of many in this industry are sufficiently scandalous to give the whole shooting match - good eggs and all - a very bad name. The trouble is that we do not seem to have got to grips with the rotten core of the industry, because the private pensions mis-selling scandal that affected millions of people and cost up to £15 billions in compensation and costs was merely the start of a horror story of malpractice that continues to-day. I'm not saying that all mal-practice is dishonest - some fair part is down to simple basic incompetence.

The responses of government and the regulators have been sporadic and rather feeble. We are after all, talking about malpractice that ruins lives - if they were pharmaceutical companies, I'm sure more would have been done.

So, in summary:

- A large part of the populace is rather naïve and certainly under-educated when it comes to matters financial.

- On the one side people have been bombarded with inducements and temptations to spend now and let the future go hang. They are constantly bombarded with seductive messages offering them cheap money to enable them to buy whatever they want right now and pay later.

- And, on the other hand, when they do try to act responsibly and put money aside, a sufficient number of them have been badly burned by the financial services industry to spread doubt and anxiety, thus lowering the incentive to save with confidence by a large amount.

This is not a happy picture. Much will have to be done to educate and support people about their financial lives and stop the financial services industry ripping us off, profiteering and shooting itself in the foot. The populace also needs guidance about tempering their expectations. Without being 'nanny' there should be much more education about simple budgeting and what happens to people who live beyond their means. It would be good if this education started in schools.

Then, the investment banking industry needs to be persuaded and incentivised to stop behaving irresponsibly and jerking investment markets from one crisis to another. I'll bet a pound or two that the current Hedge Fund craze will cause another round of destabilization, so soon after the dot.com mania.

The financial market is also undermining companies that ought to be the wellsprings of long term value creation, thus changing the face of employment and corroding the prospects of many who depend on them for employment and long term security.

It would also help if companies could be run as though there really was such a thing as the long term - that way more value would be created, some of which could go to underpin pensions.

This is some agenda and goes way beyond mouthing platitudes about the fact that we are all living longer and will consequently have to save more or work longer, true though this may be. It amounts to a need for wholesale reform of education for life, industry, investment and the financial services industry.

Tell you what - let's put the facts and figures in a separate section for people to dip into if they wish and knock off for now.

How about something succulent like a steak and kidney pud. and a bottle of Cabernet Sauvignon?

Hamilton.

We come to the difficult bit - what to do - next. Maybe a bit more onerous than ranting! However, I'm sure that we have a few useful ideas to put in the pot the next time we meet.

I like the food and wine choice. Let's go!