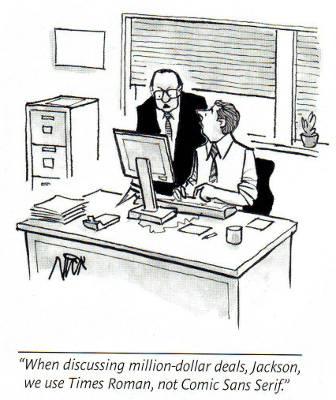

million-dollar deals

million-dollar dealsCOMMON SENSE: BIG MERGERS DON'T WORK

Sooner or later, they end in company failure and large layoffs.

They only benefit investment bankers and a few corporate “deal-meisters” who get out before the music stops.

The book, “Having Their Cake”, published in 2004, but researched in 2002, made a feature of the effects of big corporate deals, mergers and acquisitions on company fortunes and the value of enterprises. It was evident that the only real beneficiaries were the investors in the acquired companies, investment bankers and a few “superhero” CEOs who made their reputations by big deals and then moved on.

The merger of Hewlett Packard, once a very durable and successful technology company with a strong corporate culture, and Compaq, a computer manufacturer was covered in the book. The background to this takeover was interesting.It was pushed through by then CEO Carly Fiorina, who it was said used the deal as a power play, having failed to gain the support of the Hewlett Packard staff and management, or that of Walter Hewlett son of a co-founder.

Here's an excerpt from Having Their Cake, written at the time of the merger in 2001/2:

“The M&A story of 2001/2 has been the proposed merger of computer hardware manufacturer Hewlett Packard, a company that is very famous for its culture, enshrined in a creed called “The H-P Way”; and Compaq, a large personal computer maker.

The merger proposal has brought Walter Hewlett, son of one of H-P's founders and Carly Fiorina, the current H-P CEO, into head to head confrontation.

The issues are classical. On the one hand, Ms. Fiorina, who had previously tried to merge Hewlett Packard with Price Waterhouse, claims that consolidation of the personal computer industry provides a once in a lifetime opportunity to offer customers end-to end systems solutions and that the combination will be able to offer complementary product lines in PC's, servers, storage and services support. The company backs this by offering $2.5 billion of synergies and “expects these to outweigh post-merger revenue losses of about 5%”.

Ms. Fiorina is reported to have a steely resolve to bring this huge merger to fruition despite much opposition. In an interview, she reported merger teams to be standing by, professed herself to be totally committed to the logic of the merger, but said that there could be some difficulties with “the squishy bits”. (The fact that the two companies have markedly different cultures). She and her opposite number in Compaq have been reported as standing to gain many millions of dollars in bonuses and other forms of remuneration when the deal goes through- and of course hungry investment bankers are standing by.

On the other side of the argument is Mr. Hewlett, who opposes the merger on the grounds of over-optimism about the synergies and the fact that the vastly different cultures of the two companies will make effective integration virtually impossible. He argues that the combined company will lose 25 cents in earnings from every dollar of lost revenue. Ms. Fiorina and her advisers argue for a loss of 12 cents. She also says that the merger would be substantially earnings-accretive in the first year after the merger and attacks Mr. Hewlett as having a “simplistic anti-merger bias”. Employees have weighed in with a view, mounting a demonstration demanding “Two job losses rather than 15,000”. The “two” are presumably the jobs of Ms. Fiorina and the chairman of Compaq.

The whole affair has been given a real boost by the fact that both sides have enough money to mount really lavish campaigns and use the best advisers.

Having lost the big battle, Mr. Hewlett, whose family have about 18% of the shares, has said that he will stay on the board to try and look after the best interests of HP employees and salvage something after the merger fails.This 'spectacular' is rather special, because there has been considerable investor and press opposition to the deal on the grounds that the dream of synergy is more likely to prove to become a nightmare.

Readers may be interested to follow the fortunes of the merged entity to see how the share price progresses over the next few years. The authors have already placed their predictions in a sealed envelope”.

Cut to the present and recent past

Ms Fiorina is history. She was forced out a couple of years after the merger, as the company failed to deliver its expected “synergy” benefits and was obviously struggling to make the merged entity work. There followed a regular sequence of layoffs as the underperforming giant staggered from one mini-crisis to another. There were significant redundancies in 2009, 2010 and 2011.

A big layoff programme - May 2012

The following is a report from the London Evening Standard of May 23, 2012:

Hewlett Packard has warned of cuts in its UK operation in a global purge that will see it axe 27,000 workers.

The US technology company plans to make the cuts, which amount to 8% of its global workforce of almost 350,000 people, as it struggles for sales in a marketplace increasingly dominated by smartphones and tablet computers.

HP, which has its headquarters in Palo Alto, near San Francisco, California, said the job cuts, along with other measures, should save it £2.2 billion which it would invest in growth areas like "cloud" storage technology.

A spokeswoman said: "We do expect the workforce reduction to impact just about every business and region."

One of those leaving is Dr Mike Lynch, chief executive of HP's Autonomy division, formerly a UK-based stand-alone company he founded in 1996 and sold to HP last year for £7.1 billion.

Cambridge University graduate Dr Lynch, who made £500 million from the sale, is being replaced by Bill Veghte, HP's chief strategy officer "to help improve Autonomy's performance".

Dr Lynch will leave after what the company called a "transition period".

HP says it hopes to reduce the number of redundancies by offering an early retirement programme. Workforce reduction plans will vary by country, based on local legal requirements and consultation with works councils and employee representatives.

The firm's chief executive Meg Whitman, also a former CEO of eBay, said the cuts were needed to ensure HP's long-term health. (!!)

Walter Hewlett was right, the merger has failed to create a successful company. But why?

The reasons are quite simple.

They are that:

- The people pushing mergers, top executives and investment bankers, will have little understanding of the operational complexities of two large businesses, even those that superficially seem similar. So, synergistic benefits that might be gained from operational effectiveness will be difficult to achieve. This means that managers and bankers turn to a different form of “synergy” - cost reduction. Whilst reduced costs are one prize, those done from afar in corporate offices usually cause more disruptive harm than good.

- The process of merging different businesses with different histories, products, systems and customers is hugely complex. Even more complex is the human aspect of mergers. No matter how carefully mergers are planned, there will be winners and losers, tribal conflicts, different habits and ways of doing things. Old loyalties on both sides will have to be abandoned, new cultures take years to establish. And in the usual rush to please the investment markets, it is almost certain that valuable knowledge, experience and skills will be lost.

- The reasons for making acquisitions are too often ego and greed cloaked in a thin veil of rationality. Many top managers relish conquest and the thrill of the chase. They are almost invariably egged on by investment banking advisers who stand to gain massive fees for simply making the acquisition whether it succeeds in creating value or not. It should not be too difficult to envisage that bids are overvalued, strategies behind the deal are fudged and the impacts on employees and customers virtually ignored in the thrill of the hunt.

So why do people do it?

The evidence is almost overwhelming: big mergers don't work in creating durably successful enterprises. But understanding this requires broad-based experience of business from the front line up and a good grasp of non-financial human factors. Furthermore, understanding requires a cool appraisal of long term factors unclouded by the prospect of short term gain. Alas, most bankers and high ego, financially oriented chief executives don't have this kind of understanding - and they are followed with enthusiasm by the business media, which in the main loves a drama and has an almost day-to-day time horizon. So, by the time the disasters strike as with Hewlett Packard, they are treated as today's phenomenon and the root causes are forgotten. Just another symptom of the contemporary malaise of short-termism and “financialisation” of everything.

What does work?

Experience tells that acquisitions can be a part of successful growth strategies. It is important to emphasise that only organisations which are well-founded and operationally strong can successfully manage acquisitions. Also important is the emphasis on “a part of” a growth strategy - not the strategy itself.

From my own extensive experience, the best kind of acquisitions are relatively small, can be easily assimilated into the acquiring company's operating infrastructure and are closely akin to the acquirer's core business. But most important, the acquisition process should be led by the operating managers who will subsequently be responsible for managing assimilation and subsequent operations. The use of specialist legal or financial support should be controlled by the managers who are responsible and subsequently accountable for success. And finally, managers need to be clear that they can walk away from a deal if they believe that any significant aspect is suspect.